As part of our efforts to continuously enhance the customer experience and service quality for all our partners and customers, we are pleased to announce that three branches have relocated to new locations on 29 January 2024.

The new location details are as below:

Tawau

Address: TB 4006, Ground Floor Taman Berkeley, Batu 2 Jalan Apas, 91000 Tawau,Sabah

Phone Number: 089-762633

Batu Pahat

Address: NO. 7 & 7A, BP Avenue, Jalan Abdul Rahman, Bandar Penggaram, 83000 Batu

Pahat Johor

Phone Number: 07-432 6199

Kuala Lumpur – Jalan Yap Ah Shak (Counter)

Address: Menara Liberty, Jln Sultan Ismail, Chow Kit, 50350 Kuala Lumpur, Wilayah

Persekutuan Kuala Lumpur

Phone Number: 03-2693 2937

We believe that these efforts will play a significant role in our aspiration to become the Leading General Insurer in Malaysia.

Thank you for your support.

Related News

- The Star: Liberty Unveils New Auto Insurance that Puts Policyholders in the Driver's Seat

- Carsense: Liberty 推出全新汽车保险 让保单持有人掌控主动权

- Rama-rama.my: Liberty Unveils New Auto Insurance that Puts Policyholders in the Driver's Seat

- Businesstoday.com.my: Liberty Launches auto365 Comprehensive Lite, New Innovative Auto Insurance

- Beritakini.biz: Liberty Unveils New Auto Insurance that Puts Policyholders in the Driver's Seat

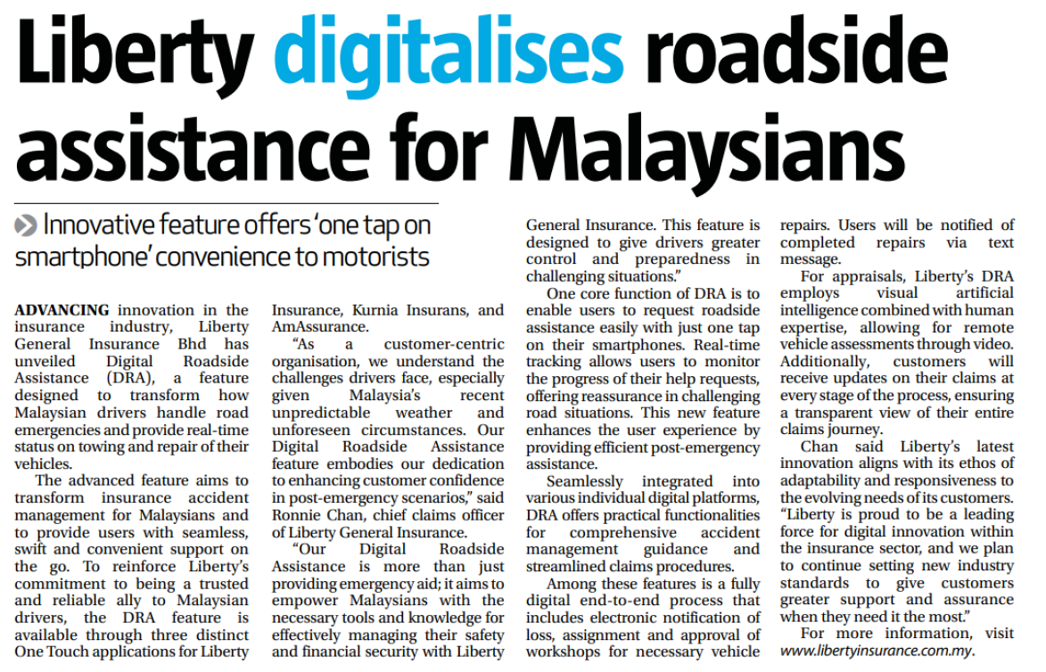

Liberty digitalises roadside assistance for Malaysians

Innovative feature offers 'one tap on smartphone' convenience to motorists

Read similar news here:

- The Star | Digitalising roadside assistance to support Malaysian drivers

- Logistics.asia | Liberty Insurance Digitalises Roadside Assistance for Malaysians

- Gohedgostan.com | Transformasi Bantuan Tepi Jalan Digital

- Ramarama.my | One Tap, That’s All: Digitalising Roadside Assistance for Malaysians

- Sin Chew | Liberty General Insurance launches DRA to streamline insurance claims processes for motor accidents

As part of our efforts to continuously enhance the customer experience and service quality for all our partners and customers, we are pleased to announce that the Taiping branch has relocated to a new location on 20 November 2023.

The new location details are as below:

Address: No 36, Jalan Maharajalela, 34000, Taiping, Perak

Phone Number: 05- 8072254

We believe that these efforts will play a significant role in our aspiration to become the Leading General Insurer in Malaysia.

Thank you for your support.