Tuesday, 28 March 2023: SME Asia, Features

In the Asian edition of Forbes’ highly coveted 30 Under 30 list 2022, 11 of the 300 honourees who made their mark across various fields were Malaysians. There is no denying that in recent times, young Malaysian entrepreneurs (especially those aged 30-40) have been making waves around the world.

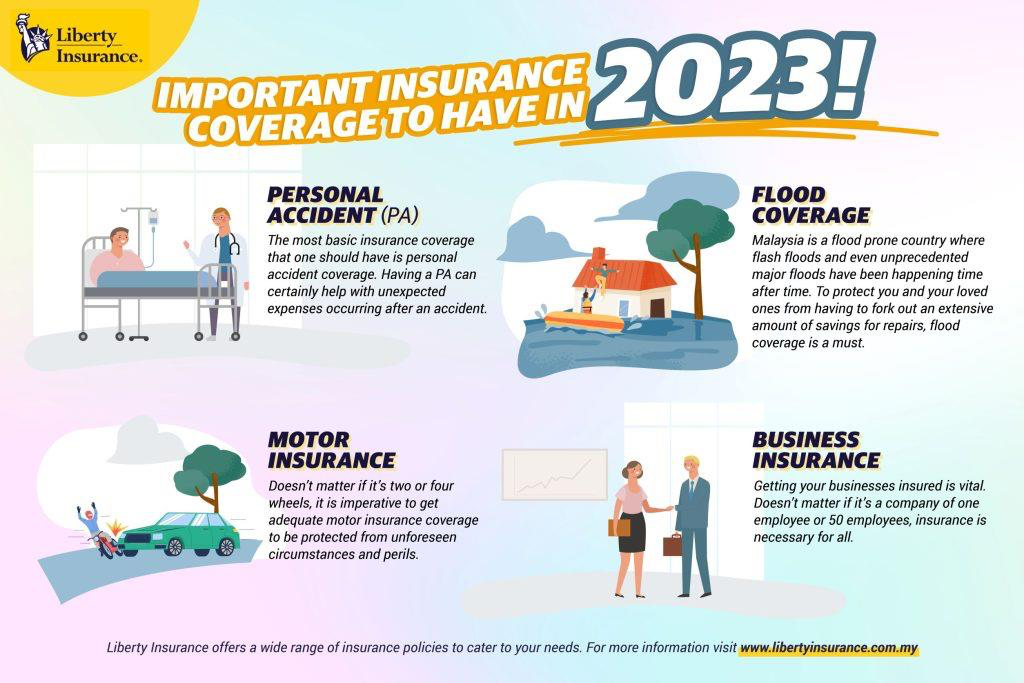

Indeed, starting a business can be a thrilling and rewarding experience. However, new entrepreneurs, especially, are likely to encounter a wide range of risks that could threaten their business. Insurance is one way to mitigate this.

Having that in mind, Liberty Insurance would like to emphasise the importance of insurance in protecting businesses from potential risks. Let’s take a closer look at just some of the risks that entrepreneurs face and how insurance can help mitigate them.

Types of risks

Firstly, there are liability risks. Business owners are responsible for ensuring that their products and services are safe and do not cause harm to their stakeholders. However, accidents and mishaps do happen, and business owners could find themselves facing a costly lawsuit if someone is injured or falls ill due to a business’ products or services.

In this case, insurance can help protect from financial ruin by covering the costs of legal fees, damages, and settlements.

Secondly, there are financial risks that businesses face, such as market fluctuations, credit risks, and currency exchange risks. These risks can have a significant impact on a business’s financial performance and stability.

Insurance can help businesses manage these risks by providing coverage for financial losses related to these risks.

Lastly, cyber threats are also on the rise, and cyberattacks can be especially damaging for small businesses.

Without insurance, the cost of repairing damages to software, hardware, and data breaches can be significant. It is important to note that new risks and threats are constantly emerging.

To determine which insurance policies best fit their needs, young business owners should take the time to understand what their businesses require. Insurance providers, such as Liberty Insurance, offer customized policies to suit the needs of different businesses.

Making an informed decision is essential since one-size-fits-all policies may not suffice.

Here are some handy tips for young business owners to consider the right insurance policy for a business:

- Assess the risks: Start by identifying the risks that are unique to your business. This will help you determine what types of insurance policies you need to protect yourself and your business. Look for policies that have a range of coverages that can protect your business from the risks you face.

- Research and compare: Once the required types of insurance policies are identified, research and compare different insurance providers to find the best coverage for your needs. Check their reputation, coverage options, pricing, and customer service reviews and ratings.

- Get professional advice: It can be helpful to consult with someone in the know someone you can trust – who can provide you with expert advice and help you navigate the complex world of insurance.

- Review your policies regularly: As your business grows and evolves, your insurance needs may change. It is important to review your policies regularly to ensure that you have adequate coverage.

As a business owner, it’s important to understand the risks your business face and to choose the insurance product that can help you mitigate the financial losses. With Liberty Insurance by your side, you can pursue your passion with confidence. For more information about Liberty Insurance, visit www.libertyinsurance.com.my.