With the recent unpredictable extreme weather conditions in Malaysia, there is no way of knowing just what drivers might face on the road. More so with the current heatwave that has been causing fiery waves nationwide, from peat fires to forest fires, open burnings and even properties and motor vehicles catching fire.

Extreme weather may be unpredictable and uncontrollable. Hence, staying prepared and protected during the anticipated long-lasting heatwave until August is crucial. This includes knowing how to stay cool and ensuring our motor vehicles remain in good condition. Just like us, extreme heat places additional stress on vehicles, potentially leading to performance issues or breakdowns. Dealing with a breakdown in sweltering heat is far from ideal, especially if you're required to be on the road for most of the day in extreme humidity.

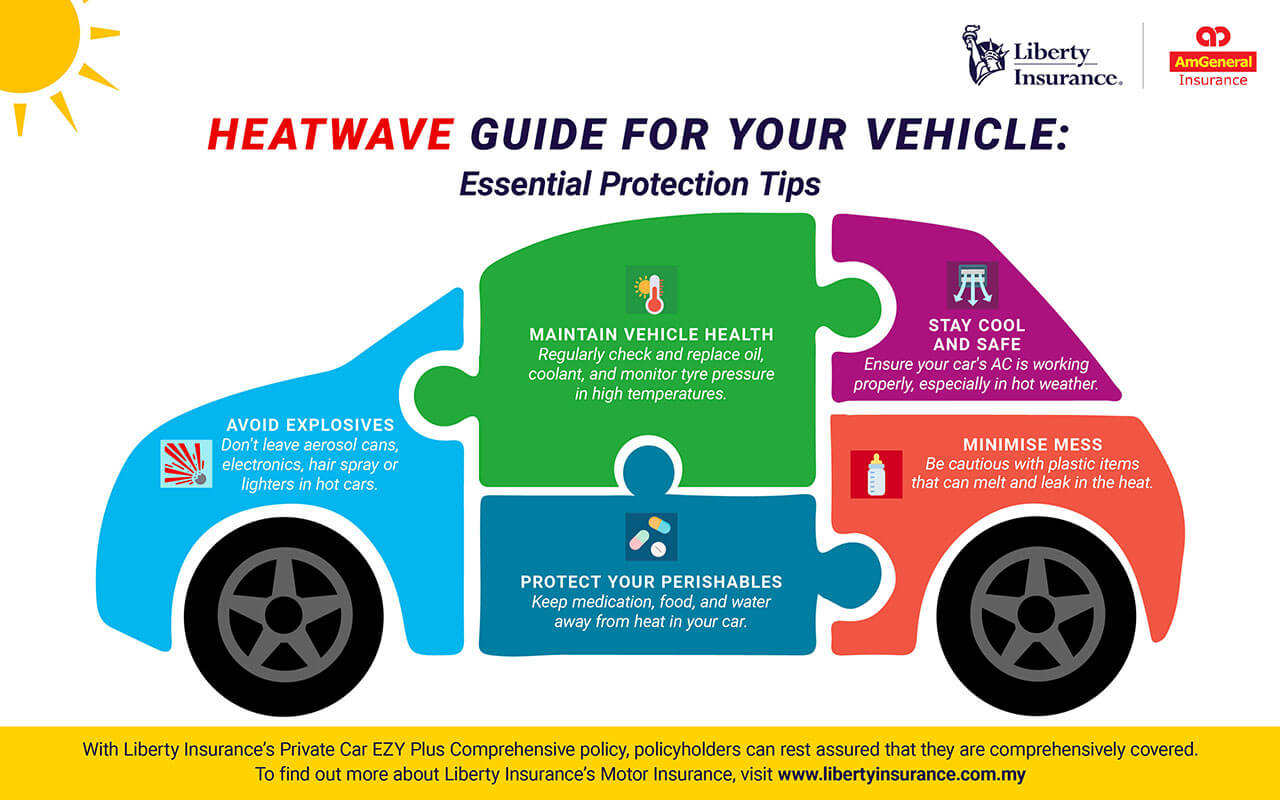

To keep your motor vehicle functioning well and ensure your safety, here are some essential tips to consider.

Identify potential explosives

Keep items like aerosol cans, electronic devices and lighters out of the parked car. Items that are packed in a pressurised can such as hairspray or even pepper spray may explode when the temperature inside the car rises above 50 degrees Celsius. While most may think that this is unlikely to happen, a stationary car under the hot sun for hours on end may record a high internal temperature. Electronic devices like laptops, cameras, power banks or even USB drives may malfunction from heat damage.

Heat kills perishables

Don't leave consumables such as medication, food items or water in the car under the sun for long. High temperatures reduce medication effectiveness and pose potential life-threatening risks if taken. Heat promotes bacterial growth in water bottles, contaminating the water. Plastic bottles act as fire-starters by magnifying sunlight. Remember, wine corks may pop and canned soda can turn rancid or taste off when exposed to heat. Safeguard perishable items from heat-related issues.

Check the vitals of your vehicle

High temperatures can damage your vehicle, affecting both the engine and tyres. Prevent engine overheating by regularly checking and replacing engine oil and coolant levels. As temperatures rise, tyre pressure tends to increase, which can be hazardous on the road and lead to brake issues due to excessive wear. Lastly, inspect batteries for corrosion and dirt build-up to maintain proper chemical balance and optimal performance.

Leave the mess at home

Parents with children should be more wary of what items are brought into the car. While crayons, markers and even pens may seem like a harmless item to bring into the car, heat can in fact deform plastic pens and markers. Its ink will even leak and crayons may melt into a gooey mess due to the heat in the car. This may cause damage to the vehicle’s interior and it is another mess for you to clean up.

Stay cool in the car

One of the most important things to take note of is the vehicle’s air-conditioning unit. If the air-conditioning unit is faulty, it will be a dangerous ride. With temperatures on the rise, it will also cause passengers to become agitated, uncomfortable and could even cause a heat stroke especially if you stay under the sun for too long. So, if your vehicle’s air-conditioning unit is struggling to cool down the vehicle then do get it fixed immediately.

In addition to these tips, be even more prepared and protected with a motor insurance that protects you, your loved ones and even your vehicle.

With Liberty Insurance’s Private Car EZY Plus Comprehensive policy, policyholders can rest assured that they are covered when it comes to coverage for Personal Accident, Medical Expenses, Key Replacement and Child Seat Replacement. For a more comprehensive coverage, policyholders can also opt for the EZY Plus Bundle premium add-ons which includes 24-hour unlimited mileage towing for breakdowns or accidents, a flood inconvenience allowance, coverage for side mirror damage, and a warranty for workmanship repairs. With the convenient Liberty Own Damage (OD) Express Claim process, claims can be quickly made through a smartphone within 48 hours.

Chief Executive Officer (CEO) Puneet (Pasha) Pasricha

Chief Executive Officer (CEO) Puneet (Pasha) Pasricha It is advisable to invest in high-quality locks or deadbolts that can slow down the break-in process and make your home less appealing to burglars. Picture for illustration purposes only. – AFPpic

It is advisable to invest in high-quality locks or deadbolts that can slow down the break-in process and make your home less appealing to burglars. Picture for illustration purposes only. – AFPpic