Wednesday, 22 February 2023: SME Asia, Features

A lot of unexpected things can happen in life and if you have not already signed up for sufficient insurance coverage, now is the best time to do so to protect yourselves from unforeseen perils or risks that may happen anytime throughout the year. With adequate insurance coverage, you can glide through 2023 with peace of mind knowing that you and your loved ones are covered financially in times of emergency.

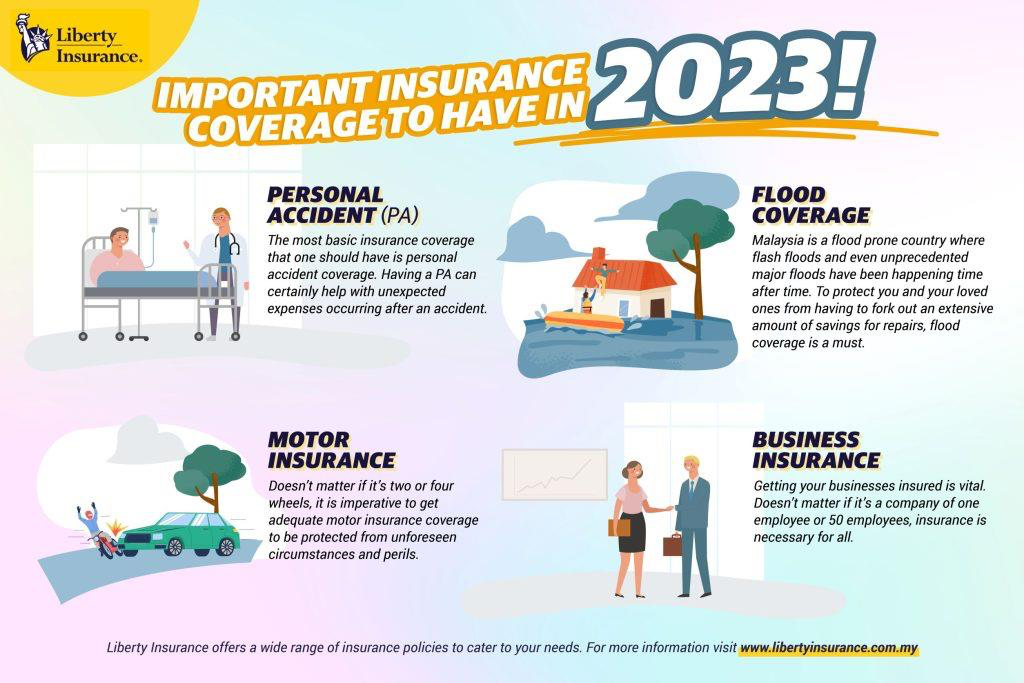

With that in mind, Liberty Insurance would like to share a few different types of insurance coverage that you may want to consider equipping yourselves with this 2023 for holistic coverage. If you already have this insurance, do ensure that it is adequate and covers all aspects necessary.

Protect Loved Ones from Financial Ruin

First and foremost, the most basic insurance coverage that one should have, is personal accident coverage. Some might not know this but having Personal Accident (PA) insurance can be a literal lifesaver especially when your world is turned upside down due to an accident. Having a PA can certainly help with unexpected expenses occurring after an accident. Especially, if you are the sole breadwinner of the family, having a PA is essential.

Liberty PA Guard policy provides you and your family with comprehensive 24/7 worldwide coverage and protection against unexpected circumstances. It covers accidental death, permanent disablement, medical expenses, snatch theft, personal liability, and up to 23 benefits in total.

Be Prepared for a Rainy Day

Let’s face it, Malaysia is a flood-prone country where flash floods and even unprecedented major floods have been happening time after time. Have we not learned from past experiences yet? With Malaysia’s heavy rainfall annually, it is a no-brainer to ensure that your insurance includes flood coverage.

Some might argue that flood coverage is not needed as they do not live in a flood-prone area, but judging by the past two years of merciless continuous rainfall, even the most unexpected places can end up flooding leaving behind damaged homes and vehicles in the blink of an eye. That said, to protect you and your loved ones from having to fork out an extensive amount of savings for repairs, flood coverage is a must.

New Year, New Wheels

With all the amazing year end and new year deals out there, it is hard not to be tempted by the good deals and own a new vehicle. Be it a trade up or the first ever vehicle owned, it is imperative to get adequate motor insurance coverage. Doesn’t matter if it’s two or four wheels, an insurance plan is necessary to be protected from unforeseen circumstances and perils.

Meanwhile, the Private Car Comprehensive Tariff policy protects your vehicle from damages caused due to unexpected accidents. It covers every aspect of your vehicle, as well as protecting you against liabilities to third parties. With this policy, your vehicle is also covered by loss or damage to your own vehicle due to fire, theft, accidents, and Third-party bodily injury and death cover.

As for the Motorcycle Comprehensive, it covers losses caused by Own Damage, fire, or theft and also protects owners against liabilities to third parties.

May the Fortune Rabbit Shine Upon Business

With so many uncertainties and even the much-talked-about recession hitting every economic sector and industry, it is indeed worrying to think about the future of your own businesses. More so when it comes to SMEs, a lot more is at stake when something unexpected hits. This is why getting your businesses insured is vital. Doesn’t matter if it’s a company of one employee or 50 employees, insurance is necessary for all. Another wrong assumption to make is that your home insurance is sufficient if you operate your business from the comfort of your own home.

This is incorrect because a home and business are two separate entities and should be treated as such. If a fire or flood damages business assets or equipment in your own home, it is not covered by your home insurance. So, to safeguard your business, Liberty Insurance offers its BizCare plan that is a holistic plan tailored to cover every SME business needs.

In addition to BizCare, Liberty Insurance also offers Legal Shield, an add-on option that protects businesses from legal action. It not only covers legal action from third parties such as customers or other companies, it also covers legal disputes with current and ex-employees. Legal Shield aims to shield businesses from facing the full brunt of the law and its high costs.